Understanding SB 253 and SB 261: what California’s climate disclosure laws mean for your business

California is positioning itself at the forefront of climate policy. With the passage of Senate Bills 253, 261, and 219, the state introduced a sweeping climate accountability package that will force organizations to disclose emissions and climate-related financial risks. These laws are not just relevant for businesses headquartered or located in California; they signal a broader shift in global expectations around transparency, governance, and climate strategy.

For companies navigating this new landscape, the implications are significant. But so are the opportunities.

Understanding California’s climate accountability package

The climate accountability package consists of three interrelated laws:

- SB 253 - Climate Corporate Data Accountability Act: Requires large companies to report their greenhouse gas (GHG) emissions across Scope 1, 2, and 3, in alignment with the GHG Protocol.

- SB 261 - Climate-Related Financial Risk Act: Mandates biennial disclosures of climate-related financial risks and mitigation strategies, aligned with the Task Force on Climate-Related Financial Disclosures (TCFD).

- SB 219: Introduces amendments and clarifications to SB 253 and SB 261, including phased Scope 3 reporting and parent-level consolidation.

Together, these laws aim to improve corporate transparency, standardize climate disclosures, and align public and private investments with California’s climate goals.

Who needs to comply with SB 253 and SB 261?

The laws apply to companies based in the United States and abroad, provided they meet the following criteria:

- SB 253: Companies with $1 billion or more in annual revenue that are “doing business in California.”

- SB 261: Companies with $500 million or more in annual revenue that are “doing business in California.”

The phrase “doing business in California” is broadly defined. It includes any entity that engages in transactions for financial gain within the state, regardless of where the company is headquartered. This means foreign entities, subsidiaries, and supply chain partners may be subject to the rules if they have operations, customers, or financial interests in California.

Importantly, SB 219 allows for consolidated reporting at the parent-company level, reducing the burden on subsidiaries and streamlining compliance.

Why this matters locally and globally

The immediate consequence of non-compliance with California’s climate disclosure laws is financial, and the penalties are substantial:

- SB 253: Up to $500,000 per year

- SB 261: Up to $50,000 per year

Beyond penalties, the long-term implications are strategic. SB 253 and SB 261 are part of a broader global shift toward mandatory climate disclosure. While California’s laws do not directly influence international frameworks, they align with and reinforce the direction of other major standards, including:

- The European Union’s Corporate Sustainability Reporting Directive (CSRD)

- The International Sustainability Standards Board’s (ISSB) IFRS S2 framework

This convergence means companies can align their disclosures across jurisdictions, reducing complexity and enhancing credibility with investors and stakeholders.

California’s approach is also influencing other U.S. states. In New York, the proposed Climate Corporate Accountability Act (Senate Bill 3456) is similar in many ways to SB 253 and SB 261, demonstrating how California’s framework is serving as a model for emerging state-level legislation.

What’s required under SB 253 and SB 261?

SB 253 requires companies with $1 billion or more in annual revenue to report their GHG emissions annually, broken down into:

- Scope 1: Direct emissions from owned or controlled sources

- Scope 2: Indirect emissions from purchased electricity, heating, and cooling

- Scope 3: All other indirect emissions, including supply chain, product use, travel, and employee commuting

SB 261 mandates biennial disclosures for companies with $500 million or more in annual revenue to include:

- Climate-related financial risks

- Mitigation strategies

- Governance and oversight structures

These disclosures must be made publicly available on the company’s website and submitted to the California Air Resources Board (CARB). SB 219 clarifies that Scope 3 reporting will be phased in, with the first reports due in 2027 based on 2026 data.

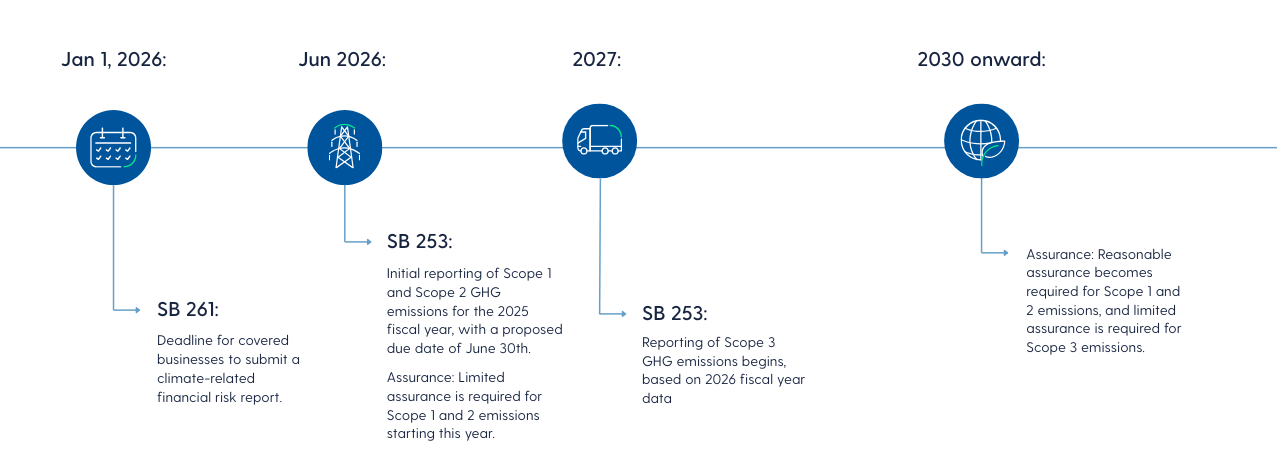

Timeline and key dates for SB 261 and SB 253

Here are the key milestones for compliance:

SB 253 and SB 261 compliance checklist

To prepare for compliance, companies should take the following steps:

- Determine applicability: Assess whether your company meets the revenue thresholds and has business activities in California.

- Conduct a gap assessment: Identify missing data, reporting capabilities, and governance structures.

- Draft your climate risk narrative: Aligned with TCFD frameworks, focus on governance, strategy, and risk management, using scenario analysis to assess resilience.

- Calculate your emissions: Use the GHG Protocol for emissions reporting.

- Engage assurance providers: Plan for third-party verification of emissions data, as required under SB 253.

How to prepare your business

Preparing for compliance requires more than just data collection. It demands a strategic shift in how companies manage climate risk and emissions.

Start by building internal climate governance. Assign roles and responsibilities, establish oversight structures, and integrate climate considerations into board-level discussions.

For many businesses, the first step is understanding their emissions profile. Talking with experts can help you assess where you stand and how to build a compliant inventory across Scope 1, 2, and 3. Scope 3 emissions are particularly complex. They require engagement with suppliers, customers, and other stakeholders. Begin mapping these emissions now to avoid delays later. World Kinect’s Carbon Accounting Service can support this process with tools and guidance aligned to the GHG Protocol.

For SB 261, consider conducting scenario analysis to assess how climate risks could impact your business over the short, medium, and long term. This will help you develop a resilient strategy and meet investor expectations.

Looking ahead

CARB’s final guidance is expected by the end of 2025. Companies should use this time to future-proof their climate strategies. Early compliance isn’t just about avoiding penalties, it’s about building credibility, attracting investment, and gaining a competitive edge.

Investors are increasingly looking for companies that can demonstrate climate resilience. Transparent disclosures, robust governance, and actionable decarbonization plans will be key differentiators in the years ahead.

How World Kinect can help

World Kinect offers a comprehensive suite of tools and services to support compliance and strategic planning:

- Carbon accounting service: Our team works with you to assess emissions across your operations and supply chain, and improve data quality, calculations, and reporting.

- Carbon accounting software: With hands on guidance from our expert team, the myWorld Carbon Management platform helps you build a complete, audit-ready emissions inventory across Scope 1, 2 and 3, aligned with the GHG Protocol and ready for third-party assurance.

- Decarbonization strategy assessments: Our assessments can help your teams to identify climate risks, model future scenarios, and develop actionable plans that align with SB 261’s financial risk disclosure requirements.

Whether you’re directly impacted by the legislation or part of a supply chain that is, now is the time to act.

Discover how our expert team can help you stay compliant, build investor trust, and strengthen your climate strategy.

Frequently asked questions about SB 253 and SB 261

Who does SB 253 and SB 261 apply to?

SB 253 applies to companies with $1 billion or more in annual revenue that are doing business in California. SB 261 applies to companies with $500 million or more in annual revenue, also doing business in California. This includes both public and private entities, regardless of where they are headquartered, as long as they engage in financial transactions within the state.

When was SB 253 and SB 261 passed?

Both SB 253 and SB 261 were signed into law by Governor Gavin Newsom on 7 October 2023.

What is the penalty for SB 253 and SB 261?

SB 253 non-compliance may result in penalties of up to $500,000 per year. SB 261 penalties can reach up to $50,000 per year.

What does “doing business in California” mean?

The term is broadly defined and includes any entity that engages in transactions for financial gain within California. This can include sales, services, or other commercial activities, even if the company is not physically located in the state.

How does SB 261 align with TCFD and IFRS S2?

SB 261 is closely aligned with the Task Force on Climate-Related Financial Disclosures (TCFD) framework, focusing on governance, strategy, risk management, and metrics. Companies already reporting under IFRS S2 can adapt their disclosures to meet SB 261 requirements, as both frameworks emphasise narrative clarity and transparency.

What is limited assurance?

Limited assurance is a form of third-party verification that provides a moderate level of confidence in the accuracy of reported data. Under SB 253, companies must obtain limited assurance for Scope 1 and 2 emissions starting in 2026, and for Scope 3 emissions by 2030.

Will SB 253 and SB 261 be delayed?

As of now, both SB 253 and SB 261 remain on track for implementation. While there have been discussions around possible amendments that could push back compliance deadlines, no formal delay has been enacted. Legal reviews and stakeholder feedback may still influence the rollout, but the current expectation is that companies should prepare for the laws to take effect as scheduled.